How Much Commissions Should I Pay?

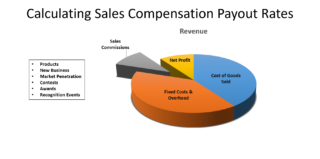

When designing a sales commission plan, you need to take into account your expected cost of sales as a percentage of the total revenue. The cost of sales has two parts, a fixed component (salaries, benefits, car allowances, etc.) and a variable component (commissions, awards, bonuses, etc.). The graphic below shows sales commissions as a percentage of the overall picture.

To estimate how much you want to pay as a commission rate, divide the targeted sales commission amount that you expect to pay by the target revenue. So, if you expect to pay $1 million in commissions for $30 million of revenue, the estimated commission payout rate would be $1MM/$30MM = 3.3%.

However, this takes everything into account. You’ll need to adjust for a few options such as product mix. Some products may be more important to the company than others, so you’ll want to pay higher commissions for these products than others. Also back out money to pay other indirect commissions like bonuses for hitting targets, awards to special accomplishments, sales contest payouts and recognition events.

Once you’ve determined your payout percentage, model the compensation plan on a spreadsheet. Conduct “what if” scenarios to determine if the plan is working as expected. Answer the following questions,

- Am I overpaying or underpaying my sales reps?

- Are commission payouts competitive with the market?

- Is the company making its targeted profit?

- Am I driving the right behaviors?

- Am I driving the right results – markets, new accounts, product mix, customer size, etc?

By setting variable sales compensation targets upfront as a percentage of the total revenue pie (including profit margin for the company) you can manage your payouts and keep your business in the black.